AIA Medical Insurance Card Malaysia

This is a medical insurance plan from AIA Insurance.

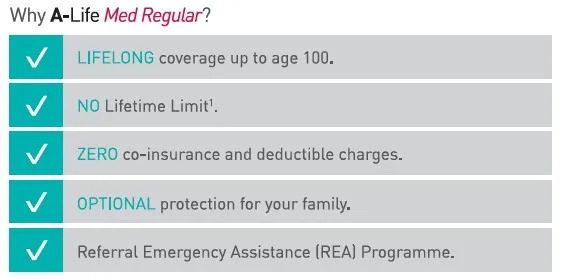

- A-Life Med Regular provides you the medical coverage up to the age 100.

- A-Life Med Regular pays your medical claim in full, without imposing any co-insurance or deductible charges.

- You can be the policy owner for your spouse and children to register for medical insurance

- You can get income tax relief with this medical card up to RM3,000

AIA Medical Insurance Card Malaysia

A-Life Med Regular is a standalone medical insurance card in Malaysia. It is a medical plan which takes care of you and your family’s long term medical needs with no Lifetime Limits.

A-Life Med Regular Benefits Summary

Lifelong Medical Coverage up to Age 100

- A-Life Med Regular provides you the medical coverage up to the age 100.

- Enrollment in this medical plan is between 0 years to 70 years old.

- Age 71 to 100 is only for renewals of policy

No Lifetime Limit

- With no Lifetime Limit, you can rest assure that you and/or your family’s healthcare needs will be taken care of.

- This is subject to the usual annual limits of most medical insurance plans

- Start from birth

Zero Co-insurance and Deductible Charges

- A-Life Med Regular pays your medical claim in full, without imposing any co-insurance or deductible charges.

- This is subject to the usual annual limits of most medical insurance plans

Optional Protection for Your Family

- You can be the policy owner for your spouse and children to register for medical insurance

- You can get income tax relief with this medical card up to RM3,000

Referral Emergency Assistance (REA) Programme

- Enjoy worldwide assistance services by calling AIA’s 24-hour service hotline +603-21665421 and reverse the call charges.

- Referral Emergency Assistance (REA) Programme services includes:

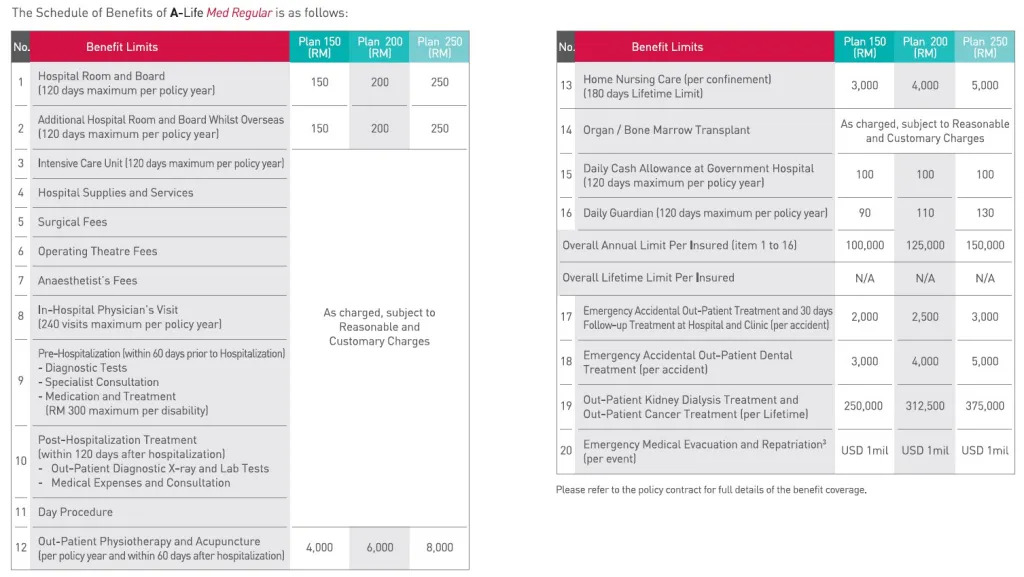

AIA Medical Insurance Card Plan Benefits

The following in-hospital care (admitted into hospital) benefits apply to the medical plan. This is refreshed and restarted every year. These benefits are subject to the plan’s annual limits. If the charges are in excess of the plan’s limits, then the individual will have to support the excess charges.

Hospital Stay

- Hospital Room and Board (up to 120 days per year)

- Intensive care unit as charged (up to 120 days per year)

- Daily Guardian stay (up to 120 days per year)

- Daily Cash Allowance at Government Hospitals (120 days per year)

Hospital Charges

- Day Procedure

- Hospital supplies and services

- Surgical fees

- Anesthetic fees

- Operating theater charges

- In-hospital physician’s visits

Cancer Treatment Charges

- Organ or Bone Marrow Transplant

- Out-Patient Cancer Treatment (per lifetime upto plan limits)

Home Nursing Care

- 180 days lifetime limit

Outpatient Physiotherapy and Acupuncture

- Within 60 days after hospitalization

- Per policy year

Emergency Treatments and Services

- Emergency Accidental Outpatient treatment

- Emergency Accidental Outpatient followup treatment

- Emergency Accidental Dental treatment

- Emergency Medical Evacuation and Repatriation

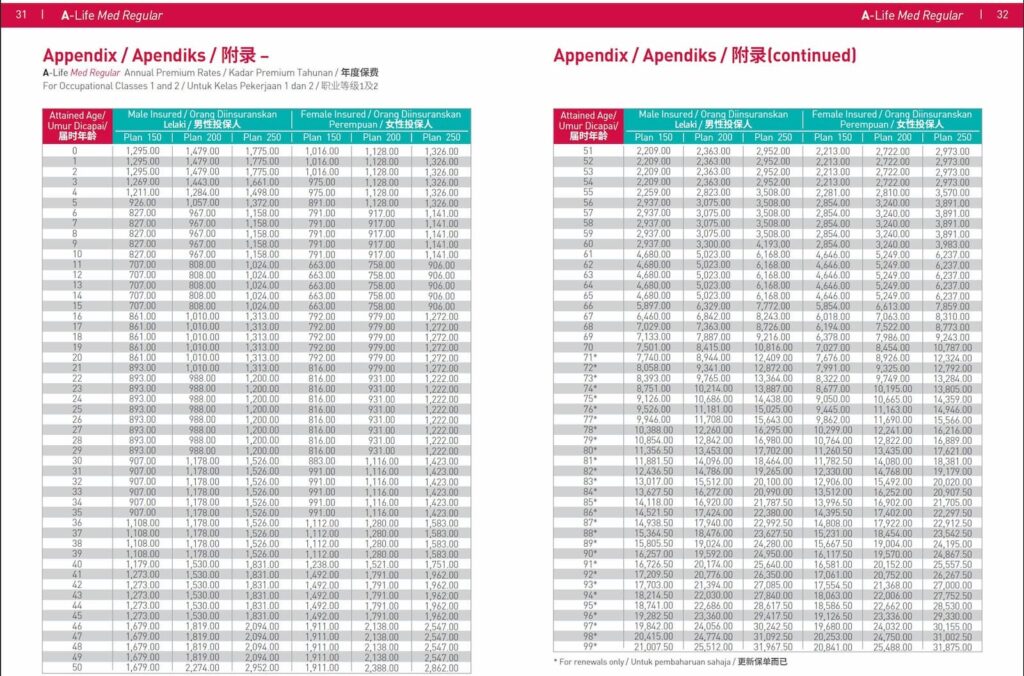

AIA A-Life Med Regular Medical Insurance Plans

This AIA Medical Insurance card has three different plans. Plan 150, Plan 200 and Plan 250. And this maps against the daily room rate of a hospital stay. You can refer to the table above for details of what you get for the plans.

Request for Quotation

Medical, Life and Group Insurance